Expanding access to safe water and sanitation in Latin America.

Azure Source Capital

The Challenge

Despite achieving the Millennium Development Goal of access to improved water resources, El Salvador and Honduras are still grappling with significant water and sanitation challenges. They have the highest proportion of populations without water on premises in Central America, indicating that the quality of their water and sanitation services is suboptimal.

Inequalities in access to quality water and sanitation services in El Salvador and Honduras are glaring. In El Salvador, while 55% of urban households have access to piped water, only 6% of rural households do. Moreover, a staggering 95% of domestic wastewater goes untreated, and over 1.6 million Salvadorans have to leave their homes to fetch drinking water. Honduras, despite having relatively higher water and sanitation coverage, suffers from low service continuity and insufficient wastewater treatment. Furthermore, there is a pronounced socioeconomic disparity in access to water, with only 73% of the poorest households having access to piped water, as opposed to over 96% of households in the highest income quintile. Given these circumstances, it is clear that greater investment into water and sanitation services would not only improve health and quality of life but could also trigger positive ripple effects on education, economic growth, and environmental conservation.

The Solution

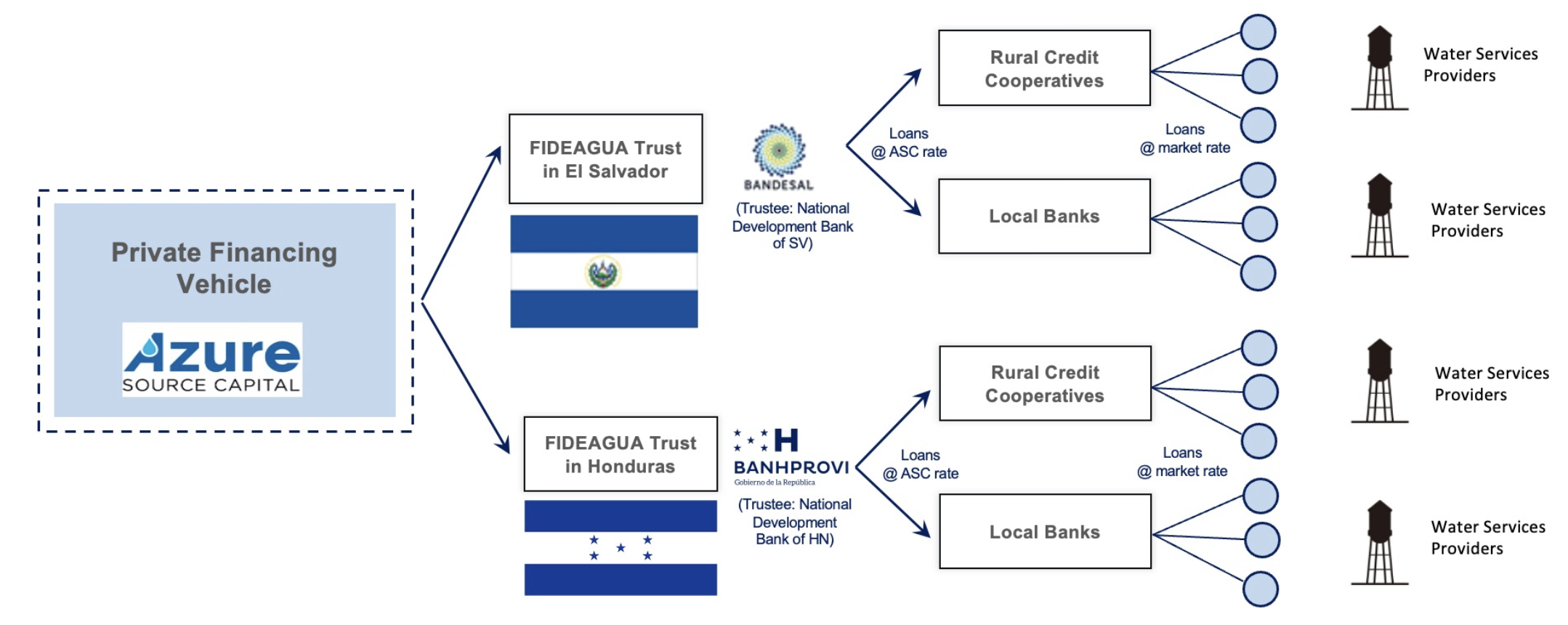

Azure Source Capital (ASC) has pioneered a transformative solution to the water and sanitation crisis in El Salvador and Honduras. Utilizing a diverse network of private and public partners, ASC connects private capital with water service providers (WSPs) in underserved communities throughout Latin America, providing them with both funding and essential technical assistance.

ASC operates as a blended finance facility, leveraging Official Development Assistance (ODA) to attract private investors. This strategic use of catalytic capital enables WSPs to bridge their financing gaps with affordable capital, improving and expanding their water systems. Meanwhile, technical assistance from partners like Azure SA in El Salvador and Agua Para el Pueblo in Honduras, as well as support from Catholic Relief Services, de-risks loans and ensures that the WSPs have the knowledge and skills necessary to enhance their operations effectively.

Since its inception in 2018, ASC has mobilized over $9 million in private capital for 23 WSPs, serving 215,000 individuals in predominantly rural and peri-urban areas. Notably, 100,000 people have experienced improved services, and 50,000 have gained first-time access to water in their households due to ASC's interventions. The initiative also targets critical Sustainable Development Goals (SDGs), including Good Health and Wellbeing (SDG 3), Clean Water and Sanitation (SDG 6), Climate Action (SDG 13), and importantly, Gender Equality (SDG 5) by addressing the disproportionate impact of limited water and sanitation services on women and girls.

Total Impact Capital’s Role

As the fund manager, Total Impact Capital leads loan disbursements, underwriting, relationships between the WSPs and local financial intermediaries (banks and credit cooperatives), cash management, fundraising, and investor relations, among other duties. Alongside its leading partners, the Inter-American Development Bank’s BID Lab and Catholic Relief Services, Total structured ASC's innovative financial structure, which empowers WSPs to upgrade and expand vital water and sanitation infrastructure and improve the lives of those residing in rural and peri-urban communities. Total Impact Capital's financial oversight (both from its HQ in Bethesda, MD, and in its regional representation in both El Salvador and Honduras) ensures that these funds are used effectively, driving measurable impact in communities with limited access to reliable water services.

The Impact

-

Expanding Access to Water and Sanitation

ASC's pivotal role in enhancing water and sanitation services, by aiding 23 water service providers and improving access for 63,000 households across El Salvador and Honduras, has significantly contributed to better public health outcomes. By ensuring clean water and improved sanitation, ASC has reduced waterborne diseases and fostered healthier communities.

-

Sustainable Growth of WSPs

Through the provision of affordable loans and crucial technical assistance, ASC has catalyzed the sustainable growth of 22 WSPs to date in underserved Salvadoran and Honduran communities. By bridging financial gaps and enhancing operational capacities, ASC empowers WSPs to extend their reach and effectively deliver continuous, affordable water services, fostering their long-term resilience and growth.

-

Enhanced Quality of Life

ASC has empowered Salvadorans and Hondurans by providing access to clean, piped water, thereby diminishing their reliance on costly bottled water. Concurrently, ASC's endeavors have fostered socio-economic growth by liberating time and resources typically spent on water acquisition, resulting in increased productivity, enhanced school attendance, particularly among girls, and promoting gender equality.

The Future

ASC's initiative holds great potential for scalability and replicability, as evidenced by its successful expansion into Honduras in 2021 and planned entry into Guatemala in late 2023, with additional LAC countries to follow. Moreover, as ASC has demonstrated the viability and de-risking impact of investments in WSPs and technical service providers, it has attracted additional private capital in the Spring of 2023, bringing its total capital commitments to $12.2M.

Leveraging CRS' geographic and technical footprint, ASC can adapt and apply similar models in other countries where CRS operates while collaborating with local partners motivated to scale with impact investment. As the initiative grows, ASC aims to secure shorter-term financing and reduce costs, offering a unique, shorter-term fixed-income product in the impact investment landscape. This product will attract a broader range of private capital providers, appealing to clients seeking impactful investments with shorter capital lock-in periods.